Kimoby Pay for Controllers

Setting up your business to use Kimoby Pay is simple, and you can enjoy next-day deposits. As a controller, it’s easy to reconcile your transactions with the Daily Reports feature. All the details required to close your books, including payment details, payment method, client information, and invoice/RO number, are sent directly to your inbox.

Quick Links

- Setting Up Daily Reports for Kimoby Pay

- Setting Up Your DMS to Make Reconciliation Easier

- How Do Payouts Work?

- What is a Pre-Authorized Charge?

- What Are Negative Deposits?

- Reconciliation of Credit Card Fees

Setting Up Daily Reports from Kimoby Pay

Edit your settings to only receive the reports you need.

From your desktop:

- Select your profile icon in the upper right corner and select Your settings.

- Select Notifications in the settings sub-menu.

- To only receive end-of-day reports for Kimoby Pay by email, check the email checkbox for Receive a daily email report of transactions on Kimoby Pay, near the bottom of the page.

Setting Up Your DMS to Make Reconciliation Easier

When possible, we recommend adding Kimoby Pay as an alternate payment method so staff can choose it when customers pay via Kimoby Pay.

Note

Kimoby does not change the status from paid to partially or fully paid in your DMS. Your staff still needs to manually do this step, similar to other forms of payments like cash or independent POS terminals.

How Do Payouts Work?

Deposits are made the next business day directly into the account you provided during your Kimoby Pay setup.

What is a Pre-Authorized Charge?

Sometimes a customer will try to pay via Kimoby Pay and receive a message saying the information provided was incorrect and asking them to retry.

In these cases, your customer may notice that their online card statement may have a pre-authorized transaction that is pending. It is important that the customer retry and successfully complete payment through Kimoby Pay or provide an alternate form of payment.

You will not receive a payment that has been pre-authorized but not completed.

Remember to always rely on the Kimoby Pay dashboard status of the transaction as it is the most reliable source of transaction statuses.

Note

If for some reason your customer does not complete payment, the pre-authorized payment on their bank statement will be removed in a few business days.

What Are Negative Deposits?

Each deposit reflects your available account balance at the time it was created.

In some cases, you may have a negative account balance. For instance, if you receive $100 in payment but have refunded $200, your account balance would be -$100. If no further payments are received to balance out the negative amount, Kimoby creates a bank transfer that will debit your bank account. If your merchant account is set up to refuse debits, the negative balance will be reported to the next deposits until the negative balance is settled.

Reconciliation of Credit Card Fees

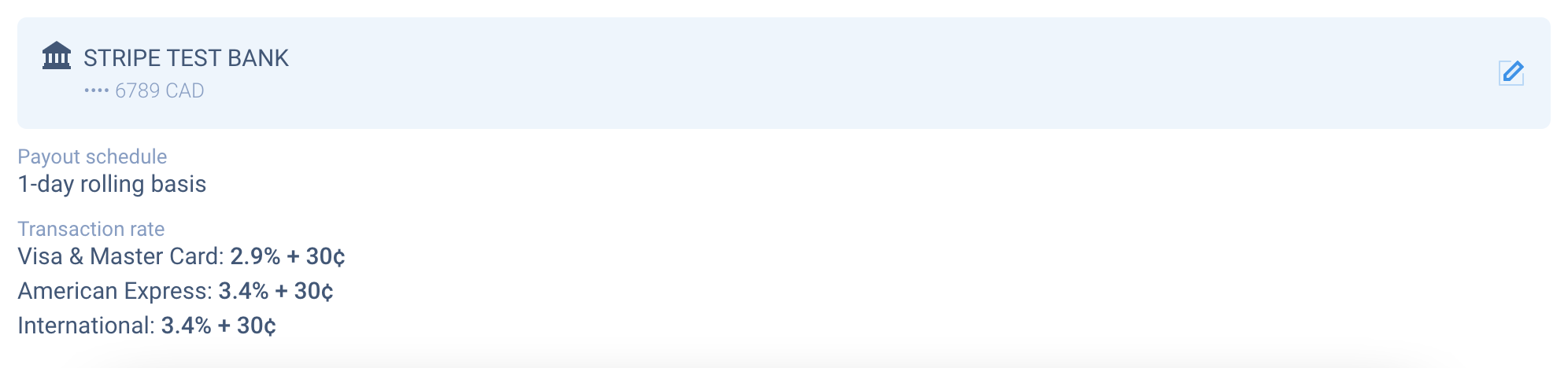

Credit card fees are charged on a per-transaction basis and are automatically deducted daily from your deposit. The Deposits section in Kimoby contains all the information you need to know to reconcile those fees should you need to do so.

You can find your credit card transaction rates in the Settings section, under Deposit information.

Learn more about setting up your Kimoby Pay Account here.